thyssenkrupp nucera Continues Stable Business Development in the Third Quarter

- Stable operational business development for the electrolysis specialist in the third quarter and stronger momentum in the first nine months of 2024/2025

- thyssenkrupp nucera increases sales and profit in the first nine months thanks to improved gross margin and strict cost management

- Next step to strengthen competitive position with strategic technology portfolio management through acquisition of high-pressure electrolysis specialist Green Hydrogen Systems (GHS)

- Very solid financial position and positive free cash flow

- Updated and more specific forecast confirmed

Dortmund, 13. August 2025 – Business at thyssenkrupp nucera has been stable and in line with expectations so far in fiscal year 2024/2025. In the first nine months, the world’s leading provider of electrolysis technology significantly improved its revenue and profit compared with the same period last year and is well on track to achieve its targets for the full fiscal year. After three quarters, the company has positive free cash flow and can continue to finance its business from ongoing operating activities.

In June, thyssenkrupp nucera further strengthened its strategic technology portfolio with the modular high-pressure electrolysis solution from Danish company Green Hydrogen Systems (GHS). The high-pressure electrolysis developed by GHS operates highly efficiently at up to 35 bar operating pressure, which is a decisive advantage for certain industrial applications where hydrogen is required in compressed form. thyssenkrupp nucera had previously entered into a strategic collaboration with Fraunhofer IKTS on high-temperature electrolysis technology (SOEC). The pilot production plant for SOEC stacks was opened in Arnstadt in May this year. “By further expanding our strategic technology portfolio, we at thyssenkrupp nucera are enabling hydrogen solutions with optimized levelized cost of hydrogen (LCOH). This makes green hydrogen more attractive,” says Klaus Ohlig, CTO of thyssenkrupp nucera.

thyssenkrupp nucera is already established as a preferred technology provider for green hydrogen production projects, with a capacity of around 1.5 gigawatts (GW) produced last year. “Europe is currently the most promising market. We are currently working on engineering orders totaling 1.5 gigawatts of electrolysis capacity. This clearly shows that thyssenkrupp nucera’s pipeline of green hydrogen projects is maturing and industrial projects are progressing. We are therefore looking ahead with confidence,” says Dr. Werner Ponikwar, CEO of thyssenkrupp nucera.

In June, the electrolysis specialist was commissioned to carry out a FEED study (front-end engineering design) for an industrial hydrogen project in heavy industry in Europe to reduce CO2 emissions. The planned water electrolysis plant will have a capacity of around 600 megawatts (MW). The electrolysis specialist has also received new orders in the chlor-alkali (CA) segment. The Chemical Marketing and Distribution Company (CMDC) has commissioned the company to implement the next expansion stage of its chlor-alkali plant in Jubail Industrial City. CMDC is part of the Basic Chemical Industries Company (BCI). thyssenkrupp nucera will supply its energy-efficient and environmentally friendly membrane technology of the latest generation.

In addition, Indian caustic soda manufacturer TGV SRAAC has commissioned thyssenkrupp nucera to expand its chlor-alkali plant in Kurnool in the Indian state of Andhra Pradesh. The package includes the supply of proprietary cell elements, while the engineering includes the cell room with electrolyzers and associated equipment. Due to the high energy efficiency of the technology from one of the world’s leading suppliers of electrolysis technology, TGV SRAAC has now opted for the latest generation of BiTAC® technology from thyssenkrupp nucera.

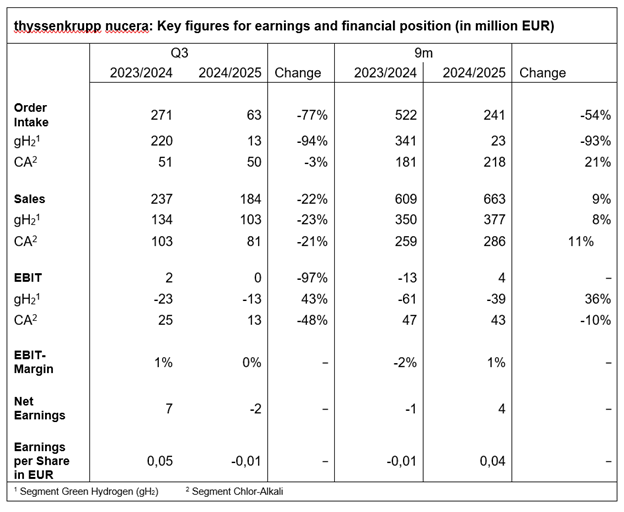

In the third quarter of the current 2024/2025 fiscal year, the difficult situation on the international hydrogen market in particular weighed on the group’s order development due to project postponements. As a result, the volume of new orders for the group fell to EUR 63 million in the third quarter (prior-year quarter: EUR 271 million). While new orders from customers in the green hydrogen (gH2) segment were below the prior-year level, the chlor-alkali (CA) segment almost matched the prior-year quarter’s level, thanks in part to the service business. In the first nine months, order intake at the group level and in the green hydrogen segment did not reach the previous year’s level, but the volume of new customer orders in the chlor-alkali segment increased by just under a quarter.

Due to the scheduled processing of customer projects, the order backlog as of June 30, 2025, is as expected at EUR 0.7 billion (EUR 1.3 billion as of June 30, 2024). The order backlog reached EUR 0.3 billion in the gH2 segment (June 30, 2024: EUR 0.9 billion) and EUR 0.3 billion in the CA segment (June 30, 2024: EUR 0.4 billion).

The high level of completion of contractually agreed projects in both segments of the electrolysis specialist led to a 22 percent decline in sales for the group in the third quarter of 2024/2025 to EUR 184 million (previous year: EUR 237 million). In the gH2 segment, sales declined by 23 percent to EUR 103 million (previous year’s quarter: EUR 134 million), reflecting the already high level of completion of the NEOM project. In the CA segment, sales fell by 21 percent to EUR 81 million (previous year’s quarter: EUR 103 million). Revenue declined in both the new construction and service businesses.

In contrast, the group’s sales rose by 9 percent to EUR 663 million in the first nine months of 2024/2025 (previous year’s quarter: EUR 609 million). The main drivers of revenue were progress in project execution in both segments. Revenue in the gH2 segment grew by 8 percent to EUR 377 million (prior-year period: EUR 350 million). In the CA segment, revenue increased by 11 percent to EUR 286 million (prior-year period: EUR 259 million).

Earnings before interest and taxes (EBIT) for the group fell in the third quarter of 2024/2025 from EUR 2 million in the same quarter of the previous year to EUR 0 million. While thyssenkrupp nucera significantly improved EBIT in the gH2 segment from EUR –23 million in the same quarter of the previous year to EUR –13 million, EBIT in the CA segment was 48 percent below the previous year’s figure (EUR 25 million) at EUR 13 million. The more profitable project mix enabled a higher gross margin in the gH2 segment. In addition, EBIT in the CA business had benefited from positive one-time effects in the prior-year quarter.

In the first nine months of 2024/2025, EBIT for the group rose from EUR –13 million to EUR 4 million. EBIT in the alkaline water electrolysis (AWE) technology business improved strongly to EUR –39 million after EUR –61 million in the same period of the previous year. In contrast, EBIT in the chlor-alkali electrolysis business declined by 10 percent to EUR 43 million (previous year: EUR 47 million). EBIT increased at the group level mainly thanks to the improved gross margin resulting from the more profitable project mix in the gH2 segment. In addition, EBIT in the same period of the previous year had benefited from positive one-time effects in the CA segment.

thyssenkrupp nucera continued to invest heavily in research and development, focusing on alkaline water electrolysis (AWE) and high-temperature SOEC electrolysis. R&D expenditure amounted to EUR 10 million in the third quarter (prior-year quarter: EUR 11 million) and EUR 24 million in the first nine months of the current fiscal year (prior-year period: EUR 25 million).

Lower interest income due to lower interest rates caused the financial result of the electrolysis specialist to fall to EUR 3 million in the third quarter of the 2024/2025 fiscal year (prior-year quarter: EUR 7 million). After income taxes, the result from continuing operations fell to EUR –2 million (prior-year quarter: EUR 7 million). The earnings per share attributable to thyssenkrupp nucera shareholders decreased accordingly to EUR –0.01 (prior-year quarter: EUR 0.05).

In the first nine months of 2024/25, the financial result was EUR 13 million (prior-year period: EUR 19 million). After income taxes, the result amounted to EUR 4 million (prior-year quarter: EUR –1 million). Earnings per share attributable to thyssenkrupp nucera shareholders rose accordingly to EUR 0.04 (prior-year quarter: EUR –0.01).

As of June 30, 2025, thyssenkrupp nucera employed 1,093 people worldwide. This represents an increase of 149 employees compared to the previous year (June 30, 2024: 944 employees).

“Green hydrogen, a climate-friendly energy source, is and will remain the central pillar of the decarbonization strategies required by industry worldwide. The growth prospects for the hydrogen market remain intact, despite the challenges currently facing the global hydrogen market. With more than 60 years of experience in electrolysis technology, we at thyssenkrupp nucera have the necessary technological expertise,” says Dr. Werner Ponikwar, CEO of thyssenkrupp nucera, ”although large-scale projects naturally have longer development times – we remain one of the most sought-after partners on the market.”

“Thanks to its business model and strict cost management, thyssenkrupp nucera continues to generate positive free cash flow even in this difficult market for hydrogen solutions. This underscores our stable financial position,” said Dr. Stefan Hahn, CFO of thyssenkrupp nucera.

On July 15, 2025, thyssenkrupp nucera specified and partially raised its forecast for the most important financial performance indicators, revenue and EBIT, for fiscal year 2024/2025.

The Executive Board confirms the forecast for fiscal year 2024/2025. Consolidated sales of between EUR 850 million and EUR 920 million (2023/2024: EUR 862 million) are still expected. At the segment level, the Executive Board anticipates sales in the green hydrogen (gH2) segment of between EUR 450 million and EUR 510 million (2023/2024: EUR 524 million). In the chlor-alkali (CA) segment, sales are still expected to be between EUR 380 million and EUR 420 million (2023/2024: EUR 338 million). According to the forecast, both the new construction and service businesses are expected to contribute to this increase.

Management expects consolidated EBIT to be between EUR –7 million and EUR 7 million (2023/2024: EUR –14 million). In the gH2 segment, EBIT is expected to be between EUR –75 million and EUR –55 million (2023/2024: EUR –76 million). An improved gross margin in the AWE segment as a result of a more profitable project mix should contribute positively to the expected EBIT development. This will more than offset rising research and development expenses in the SOEC segment, which is also included in this segment. In the CA segment, the Executive Board expects EBIT to be positive at between EUR 55 million and EUR 75 million (2023/2024: EUR 62 million). Previously, it had anticipated positive EBIT in the mid double-digit million euro range, below the previous year’s figure.

Rita Syre

Senior Media Relations Manager

Mobile: +49 174 161 86 24

E-Mail: rita.syre@thyssenkrupp-nucera.com