thyssenkrupp nucera Performs in Line With Outlook in Q1 and Invests in Further Expansion of Technology Portfolio

- First quarter order intake and sales were below previous year’s level, as market uncertainties continue to affect the green hydrogen sector

- A significant increase in Q2 order intake is expected following the signing of thyssenkrupp nucera’s largest chlor-alkali new construction project, valued in the high double-digit million-euro range

- Contractually agreed customer projects in both technology areas are nearing completion

- Improvement in gross margin due to higher-margin project mix and consistent cost management

- Confirmation of full-year forecast for 2025/2026 with rising order intake and temporary decline in sales

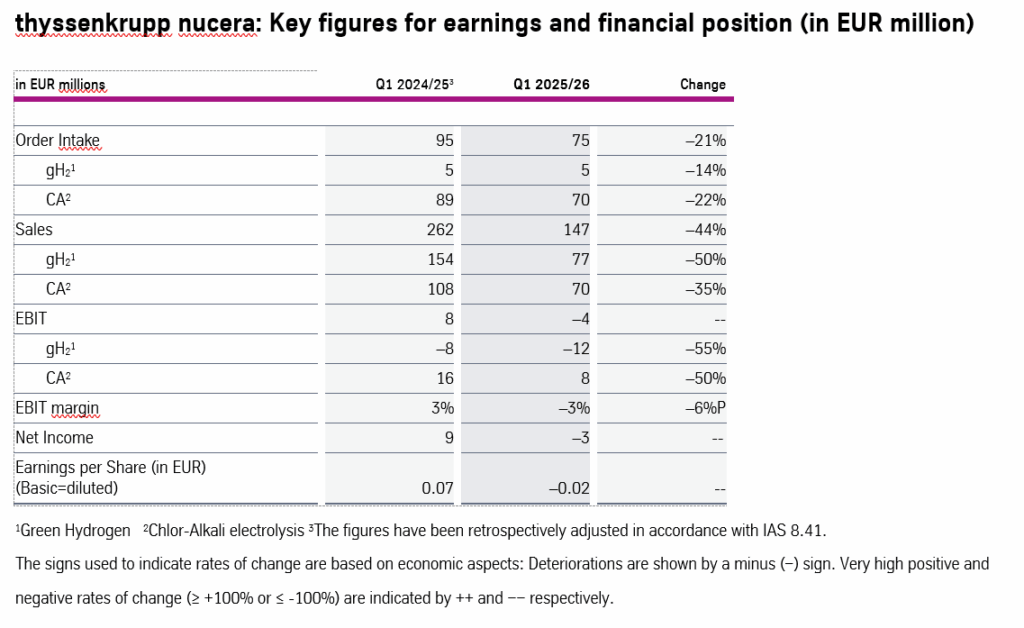

Dortmund, February 11, 2026 – thyssenkrupp nucera’s business performance in the first quarter of 2025/2026 was in line with expectations. At EUR 75 million, the Group’s order intake was 21 percent below the prior-year figure (EUR 95 million). The main reasons for this were project-related delays in the Green Hydrogen (gH2) segment and a temporary decline in new orders in the Chlor-Alkali business, which are expected to pick up significantly again in the following quarters. The order backlog amounted to EUR 489 million as of December 31, 2025, compared with EUR 606 million as of September 30, 2025. As expected, the high degree of completion of contractually agreed customer projects in the two technology areas of alkaline water and Chlor-Alkali electrolysis led to a 44 percent decline in the Group’s sales to EUR 147 million (Q1 2024/2025: EUR 262 million).

Despite lower sales, thyssenkrupp nucera continued to invest consistently in innovation. The company increased its research and development expenditure by 31 percent to EUR 9 million (Q1 2024/2025: EUR 7 million). The electrolysis specialist is strengthening its technology portfolio with innovations like SOEC high-temperature electrolysis and a modular high-pressure electrolysis solution. In addition, thyssenkrupp nucera introduced a new generation of its BM (bipolar membrane) and advanced BiTAC (bipolar ion-exchange membrane process) electrolyzers, offering higher performance with simplified maintenance and installation.

Earnings before interest and taxes (EBIT) were down on the previous year’s figure of EUR 8 million at EUR–4 million. Earnings were impacted by exceptionally high fluctuations in derivative positions amounting to EUR 2 million, which offset price fluctuations in commodity inventory positions. However, an improved gross margin and consistent cost discipline were not able to fully compensate for the lower sales volume.

The financial result decreased from EUR 6 million to EUR 3 million due to low interest rates. After taxes, the net income was EUR–3 million (Q1 2024/2025: EUR 9 million). Earnings per share amounted to EUR–0.02, compared with EUR 0.07 in the same period of the previous year. The electrolysis specialist employed 1,089 people at the end of the first quarter (December 31, 2025), compared to 944 on December 31, 2024.

“Even though the market environment remains challenging, we are seeing increasingly positive market momentum, particularly in the area of green hydrogen. In the first quarter, we demonstrated that we are consistently driving forward our customer projects as agreed and further expanding our technological strength through high R&D investments and the expansion of our technology portfolio,” says Dr. Werner Ponikwar, CEO of thyssenkrupp nucera.

High sales recognition from customer projects in the Green Hydrogen segment

Order intake in the Green Hydrogen (gH2) segment amounted to EUR 5 million (Q1 2024/2025: EUR 5 million). New gH2 business remained under pressure due to project-related delays in a difficult market environment. As of December 31, 2025, the gH2 order backlog amounted to EUR 186 million, compared with EUR 259 million in the previous quarter.

Sales in the gH2 segment halved from EUR 154 million to EUR 77 million, mainly due to the high level of sales recognition from the NEOM project in Saudi Arabia, one of the world’s largest green hydrogen production projects. The biggest revenue driver was the Stegra project in Sweden, for which thyssenkrupp nucera is supplying electrolysers with an installed capacity of more than 700 MW. The lower revenue volume led to gH2 EBIT of EUR–12 million (previous year: EUR–8 million).

In January of this year, thyssenkrupp nucera also entered into a partnership with the German Society for International Cooperation (GIZ) GmbH to promote the development of the market for green hydrogen and power-to-X (PtX) in India. The aim is to tap into the potential along the entire hydrogen value chain. India is one of the fastest-growing economies in the world and will play a key role in the global energy transition. thyssenkrupp nucera already has over 80 employees in India.

New large-scale Chlor-Alkali project in the Middle East

In the Chlor-Alkali (CA) segment, thyssenkrupp nucera secured new orders worth EUR 70 million (previous year: EUR 89 million). While new construction business increased, service business was below the high level of the previous year. A major order in the high double-digit million range for a Chlor-Alkali project in the Middle East, signed in December 2025, will be reported in the order intake in the second quarter of 2025/26 as planned. It is the largest Chlor-Alkali order for a new construction project in the history of thyssenkrupp nucera. The Chlor-Alkali order backlog as of December 31, 2025, was EUR 302 million (September 30, 2025: EUR 347 million).

In the CA segment, thyssenkrupp nucera generated sales of EUR 70 million (Q1 2024/2025: EUR 108 million). The decline is primarily due to lower new construction business. Service business, on the other hand, remained at the high level of the previous year. EBIT decreased to EUR 8 million (Q1 2024/2025: EUR 16 million). Rising gross margins and consistent cost management were only able to partially offset the lower sales volume in the CA business.

“As expected, the continuing challenging market situation is reflected in our key figures. At the same time, developments in the first quarter show that we at thyssenkrupp nucera are keeping our cost structures flexible, continuously improving our margins, and investing specifically in technologies with clear future prospects. We remain well positioned and have a high level of financial resilience,” says Dr. Stefan Hahn, CFO of thyssenkrupp nucera.

Forecast

For fiscal year 2025/2026, thyssenkrupp nucera continues to expect order intake at Group level of between EUR 350 million and EUR 900 million (2024/2025: EUR 348 million). The main drivers are expected to be large new construction projects in both segments and the service business. The Executive Board forecasts sales of between EUR 500 million and EUR 600 million (2024/2025: EUR 845 million). Sales growth is expected to be driven primarily by projects that have already been contractually agreed. Consolidated EBIT is expected to be between EUR–30 million and EUR 0 million (2024/2025: EUR 2 million). The main drivers are the processing and conversion of the existing order backlog. Cost efficiency measures already initiated are expected to partially offset the lower cost coverage associated with the planned decline in revenue.

For the Green Hydrogen segment, thyssenkrupp nucera expects sales of between EUR 150 million and EUR 220 million (2024/2025: EUR 459 million). The expected sales development is largely in line with the existing order backlog. Additional orders in the gH2 segment are not expected to have a significant impact on sales until the following years. According to the forecast, EBIT will range between EUR–80 million and EUR–55 million (2024/2025: EUR–56 million). An improved gross margin due to a more favorable project mix in the AWE segment, cost savings, and a change in resource allocation between the segments are expected to partially offset the lower sales.

In the Chlor-Alkali segment, sales are expected to be between EUR 320 million and EUR 400 million (2024/2025: EUR 387 million). Sales development is based primarily on the existing order backlog. EBIT of between EUR 40 million and EUR 65 million (2024/2025: EUR 58 million) is expected for the CA segment, which will mainly result from the processing of the existing order backlog.

Rita Syre

Senior Manager Media Relations and Financial Communications

Phone: +49 174 161 86 24

E-Mail: rita.syre@thyssenkrupp-nucera.com

More press releases