thyssenkrupp nucera Improves Sales and Earnings in Second Quarter

- Continued high revenue growth for the electrolysis specialist in the second quarter and first half of 2024/2025

- Both thyssenkrupp nucera business areas, green hydrogen and chlor-alkali electrolysis, contributed to sales growth

- Strong improvement in earnings thanks to high sales momentum, improved gross margin, and strict cost discipline

- High investments in research and development to strengthen competitive position

- Solid financial position

Dortmund, 15. May 2025 – thyssenkrupp nucera, the world’s leading provider of highly efficient electrolysis technologies, significantly improved both sales and profit in the second quarter and first half of the current fiscal year 2024/2025. The figures are in line with market expectations. The company continues to finance itself from ongoing operations in the first half of 2024/2025.

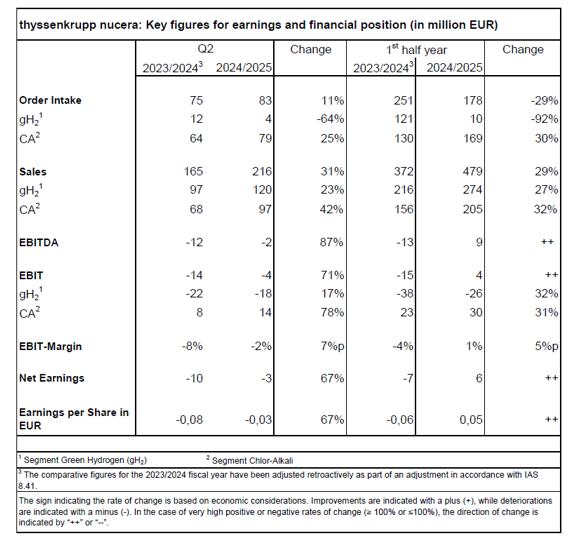

In terms of order intake, the chlor-alkali business in particular recorded strong growth in the reporting period. In the second quarter of 2024/2025, the value of new customer orders at thyssenkrupp nucera rose by 11 percent overall compared with the same quarter of the previous year to EUR 83 million (previous year’s quarter: EUR 75 million).

In the chlor-alkali segment, the company increased the amount of new customer orders by 25 percent to EUR 79 million (prior-year quarter: EUR 64 million). Order development in the chlor-alkali business was driven primarily by projects in Saudi Arabia, the U.S., and South America. This includes a project with Chlorum Solutions, which has selected thyssenkrupp nucera’s technology for the development of its first U.S. chlor-alkali plant in Casa Grande, Arizona. The membrane process from thyssenkrupp nucera is an environmentally friendly and safe technology for the supply of chlorine and its derivatives.

The continued challenging conditions in the green hydrogen market could not be entirely avoided. Regulatory uncertainties and high start-up costs continued to weigh on investment activity during the reporting period and led to project delays. Order intake in the green hydrogen (gH2) segment remained below the prior-year level in the second quarter of 2024/2025 at EUR 4 million (EUR 12 million). In the first six months of 2024/2025, order intake totaled EUR 178 million, compared with EUR 251 million in the same period of the previous year.

The scheduled implementation of customer projects led to a decline in the order backlog to EUR 0.8 billion as of March 31, 2025 (March 31, 2024: EUR 1.2 billion). In the gH2 segment, the order backlog stood at EUR 0.4 billion (March 31, 2024: EUR 0.8 billion), while in the chlor-alkali segment remained unchanged at EUR 0.4 billion (March 31, 2024: EUR 0.5 billion).

thyssenkrupp nucera’s sales rose by 31 percent year-on-year to EUR 216 million in the second quarter of 2024/2025 (prior-year quarter: EUR 165 million). Sales in both the green hydrogen (gH2) and chlor-alkali (CA) segments increased significantly. In the gH2 segment, which uses alkaline water electrolysis (AWE) technology, the Stegra project in Sweden and the NEOM project in Saudi Arabia were the main drivers of revenue growth of 23 percent to EUR 120 million (prior-year quarter: EUR 97 million). Sales in the chlor-alkali segment grew even more strongly. Sales rose by 42 percent to EUR 97 million (same quarter last year: EUR 68 million). Not only did sales in the new business improve, but so did those in the service business.

In the first half of the 2024/2025 fiscal year, the electrolysis specialist’s sales totaled EUR 479 million, exceeding the previous year’s figure (EUR 372 million) by almost a third (29 percent). Sales in the business with technologies for the production of green hydrogen increased by 27 percent to EUR 274 million (previous year: EUR 216 million). Sales in the chlor-alkali electrolysis segment for the production of chlorine and caustic soda grew even more dynamically, rising by 32 percent to EUR 205 million (previous year: EUR 156 million). Both new build and service business improved.

The provider of world-leading electrolysis technology also further increased its earnings before interest and taxes (EBIT) in the second quarter. The company improved its EBIT to EUR –4 million (same quarter last year: EUR –14 million) thanks to revenue growth, coupled with an improved gross margin and consistent cost discipline. In the gH2 segment, the company increased EBIT to EUR –18 million (prior-year quarter: EUR –22 million) and in the chlor-alkali segment to EUR 14 million (prior-year quarter: EUR 8 million), representing an increase of 78 percent. In the first half of 2024/2025, EBIT was above the previous year’s level of EUR –15 million at EUR 4 million. EBIT in the green hydrogen segment rose to EUR –26 million (previous year: EUR –38 million) and in the chlor-alkali segment to EUR 30 million (previous year: EUR 23 million), an increase of 31 percent.

To strengthen its competitive position, thyssenkrupp nucera has invested heavily in research and development, focusing on alkaline water electrolysis (AWE) and high-temperature SOEC electrolysis. R&D expenditure amounted to EUR 8 million in the second quarter (previous year’s quarter: EUR 9 million) and remained unchanged at EUR 15 million in the first half of the year.

The financial result reached EUR 4 million in the second quarter of the current fiscal year, compared with EUR 6 million in the same period last year. After taxes, thyssenkrupp nucera improved its profit from continuing operations to EUR –3 million (same quarter last year: EUR –10 million). Earnings per share amounted to EUR –0.03 (same quarter last year: EUR –0.08). In the first half of the year, the company again achieved a positive profit after taxes of EUR 6 million (previous year: EUR –7 million).

As of March 31, 2025, thyssenkrupp nucera employed 1,083 people worldwide to consistently implement its growth strategy. Compared to the previous year (March 31, 2024: 855 employees), the number of employees rose by 228.

“Green hydrogen, a climate-friendly energy source, is and will remain the central pillar of the decarbonization strategies required by industry worldwide. The growth prospects for the hydrogen market remain intact, despite the challenges currently facing the global hydrogen market. With more than 60 years of experience in electrolysis technology, we at thyssenkrupp nucera have the necessary technological expertise,” says Dr. Werner Ponikwar, CEO of thyssenkrupp nucera, ”although large-scale projects naturally have longer development times – we remain one of the most sought-after partners on the market.”

“Our business model, with its necessary high degree of flexibility, and our strong financial position—combined with strict cost discipline—give us the necessary staying power and leeway to make the necessary future investments in research and development, even in uncertain times,” says Dr. Stefan Hahn, CFO of thyssenkrupp nucera.

The Management Board has confirmed its forecast for fiscal year 2024/2025. Sales of between EUR 850 million and EUR 950 million (previous year: EUR 862 million) are expected for fiscal year 2024/2025. The implementation of projects already contractually agreed is expected to contribute significantly to sales growth.

According to the Management Board’s expectations, sales in the green hydrogen (gH2) segment are expected to be between EUR 450 million and EUR 550 million (previous year: EUR 524 million). According to the forecast, sales in the Chlor-Alkali segment will increase to between EUR 380 million and EUR 420 million (previous year: EUR 338 million), with both the new build and service businesses contributing to growth.

The Management Board expects EBIT to be between EUR –30 million and EUR 5 million (previous year: EUR –14 million) in fiscal year 2024/2025. EBIT development is largely dependent on the execution and conversion of the existing order backlog. In the green hydrogen (gH2) segment, EBIT is forecast to improve to a negative mid-double-digit million euro amount (previous year: EUR –76 million). For the chlor-alkali segment, EBIT is forecast to be in the mid-double-digit million euro range (previous year: EUR 62 million).

Disclaimer for forward-looking statements

This publication may contain forward-looking statements which address key issues such as strategy, future financial results, events, competitive positions, and product developments. These forward-looking statements – like any business activity in a global environment – are always associated with uncertainty. They are subject to a number of risks, uncertainties, and other factors, including, but not limited to, those described in thyssenkrupp nucera AG & Co. KGaA’s (“thyssenkrupp nucera“) disclosures. Should one or more of these risks, uncertainties or other factors materialize, or should underlying expectations not occur or should assumptions prove incorrect, the actual results, performances, or achievements of thyssenkrupp nucera may vary materially from those described in the relevant forward-looking statements. Such forward-looking statements may be identified by words such as “expect”, “want”, “anticipate”, “intend”, “plan”, “believe”, “seek”, “estimate”, “will”, “project” or words of similar meaning. Thyssenkrupp nucera does not intend, nor does it assume any obligation, to update or revise its forward-looking statements regularly in light of developments which differ from those anticipated.

Rita Syre

Senior Media Relations Manager

Mobile: +49 174 161 86 24

E-Mail: rita.syre@thyssenkrupp-nucera.com